NOTICE TO CLIENTS AND FRIENDS

On March 18, 2020 President Trump signed into law the Families First Coronavirus Response Act (The Act). The Act provides paid sick leave for certain employees, requires insurers and governmental payors to cover all costs of COVID-19 testing and expands food assistance and unemployment benefits. The most relevant employment-related provisions of the Act are, expanded coverage under the Family and Medical Leave Act (FMLA), emergency paid sick leave, and employer tax credits.

Emergency Family and Medical Expansion Act (COVID-19 FMLA Leave)

- Will be in effect on April 2, 2020 until December 31, 2020.

- Expanded Qualifying Reason: when eligible employees are unable to work (including telework) because he/she must care for his/her child who is 18 years of age or younger because his/her school or place of child-care has closed or caregiver is unavailable, due to the COVID-19 public health emergency. Expanded benefits are inapplicable to other types of FMLA leaves.

- Covered Employers: employers with fewer than 500 employees (instead of the general threshold under the FMLA of 50 or more employees).

- Covered Employees: full-time and part-time employees who have been employed for at least 30 days.

o Employers may elect to exclude employees who are health care providers and emergency responders from those eligible to take COVID-19 FMLA leave. - Paid and Unpaid Leave:

o The first 2 weeks of leave are unpaid. - The employee may elect to use any accrued vacation or sick leave during this time.

- COVID-19 Paid Sick Leave may be used to cover the unpaid leave period.

o During the remaining 10 weeks, the employee is entitled to paid leave at a rate no less than 2/3 of the employee’s regular rate of pay, based upon the number of hours that the employee would otherwise be regularly scheduled to work, up to $200 per day or $10,000 in total. - Reinstatement Rights:

o The employer must make reasonable efforts to restore the employee to a position equivalent to that which the employee held before the leave commenced, with equivalent pay, benefits and related terms and conditions of employment.- If the employer’s reasonable efforts fail, the employer must continue to make reasonable efforts during a 1-year period to contact the employee if an equivalent position becomes available.

o Employers with less than 25 employees are not obligated to restore the employee to his/her position if the employee’s position no longer exists due to economic conditions or changes in the employer’s operations caused by the public health emergency.

- If the employer’s reasonable efforts fail, the employer must continue to make reasonable efforts during a 1-year period to contact the employee if an equivalent position becomes available.

- Secretary of Labor: is authorized to issue regulations exempting certain business and employees from the COVID-19 FMLA Leave’s applicability.

Emergency Paid Sick Leave Act (COVID-19 Paid Sick Leave)

- Will be in effect on April 2, 2020 until December 31, 2020.

- Covered Employers: private-sector employers with less than 500 employees and public-sectors employers, regardless of the number of individuals whom they employ.

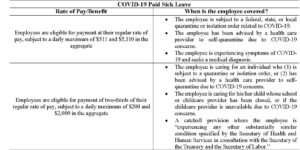

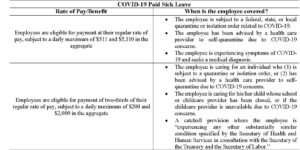

- Covered Employees: full-time and part-time employees are eligible for COVID-19 Paid Sick Leave (see table below).

o Employers may elect to exclude employees who are health care providers and emergency responders from those eligible to take COVID-19 Paid Sick Leave. - Amount of Leave:

o Full-time employees receive 80 hours of paid sick leave.

o Part-time employees receive the equivalent to the average amount of hours worked over a two-week period. - Reasonable Notice: after the 1st day of absence under the COVID-19 Sick Leave, employers may require employees to follow reasonable notice procedures in order to continue receiving the COVID-19 Sick Leave benefits.

- Secretary of Labor: is authorized to issue regulations exempting certain business and employees from the COVID-19 Paid Sick Leave’s applicability.

- Unused COVID-19 Sick Leave Balance: is not carried over to subsequent years.

- Employers Prohibitions:

o Employers are prohibited from requiring employees to use accrued sick leave under employer-provided benefits packages before using the COVID-19 Sick Leave.

o Employers are also prohibited from retaliating against employees for exercising protected rights. - Posting Requirements: employers are required to post a notice advising employees of their rights. The U.S. DOL must create this notice by March 25th

Tax Credits for Paid Sick Leave and Paid Family and Medical Leave

- The Act contains provisions that facilitate the reimbursement of a private employer’s paid COVID-19 Sick Leave and paid COVID-19 FMLA leave.

- This reimbursement is accomplished by allowing employers to credit the COVID-19 Sick Leave payments and COVID-19 FMLA payments against the employer’s FICA quarterly tax payments.

This document has been prepared for information purposes only and is not intended, and should not be relied upon, as legal advice. If you have any questions or wish to obtain more information related thereto, or about its possible effect(s) on policy or operational matters, please contact us at your convenience.