NOTICE TO CLIENTS AND FRIENDS

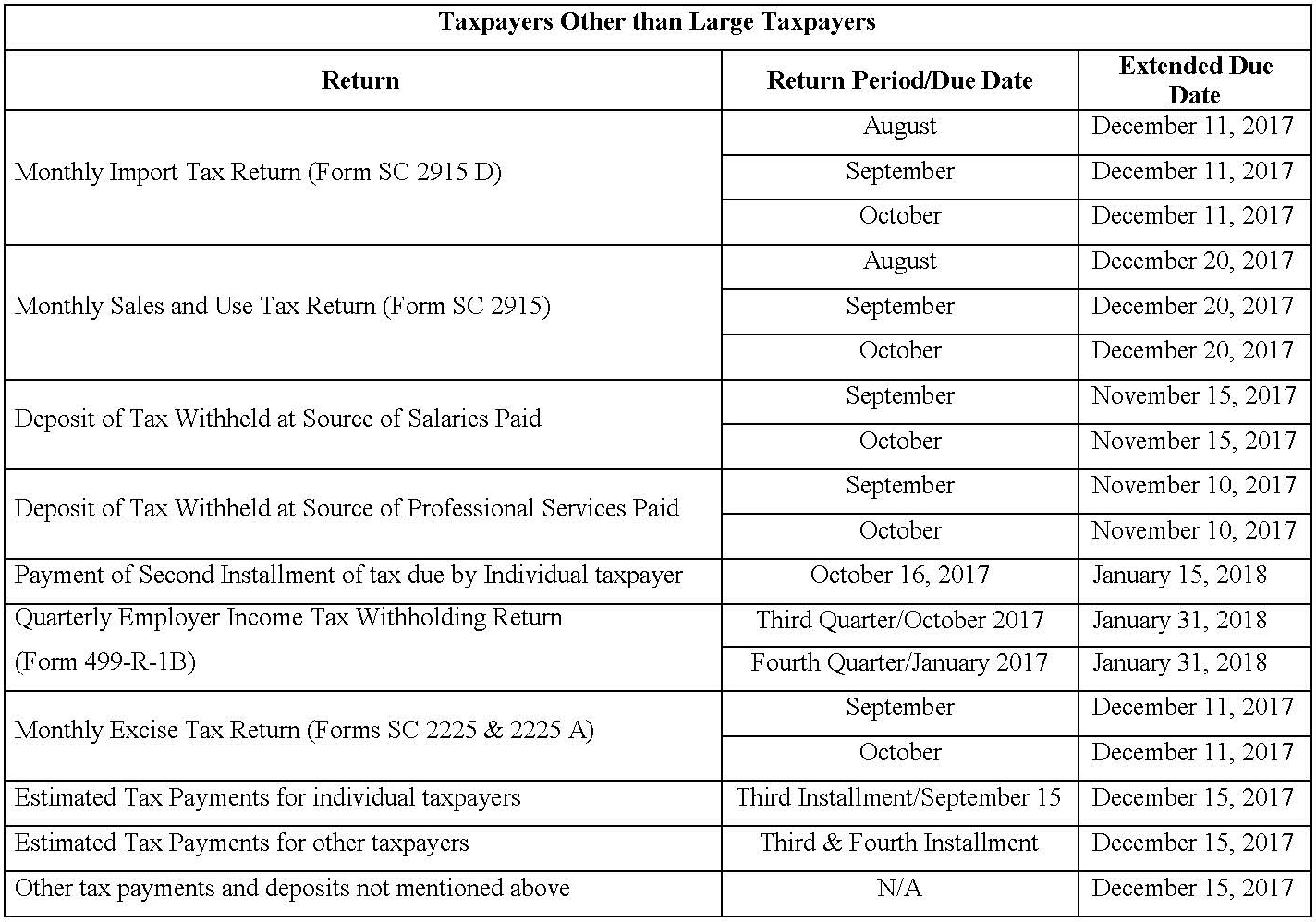

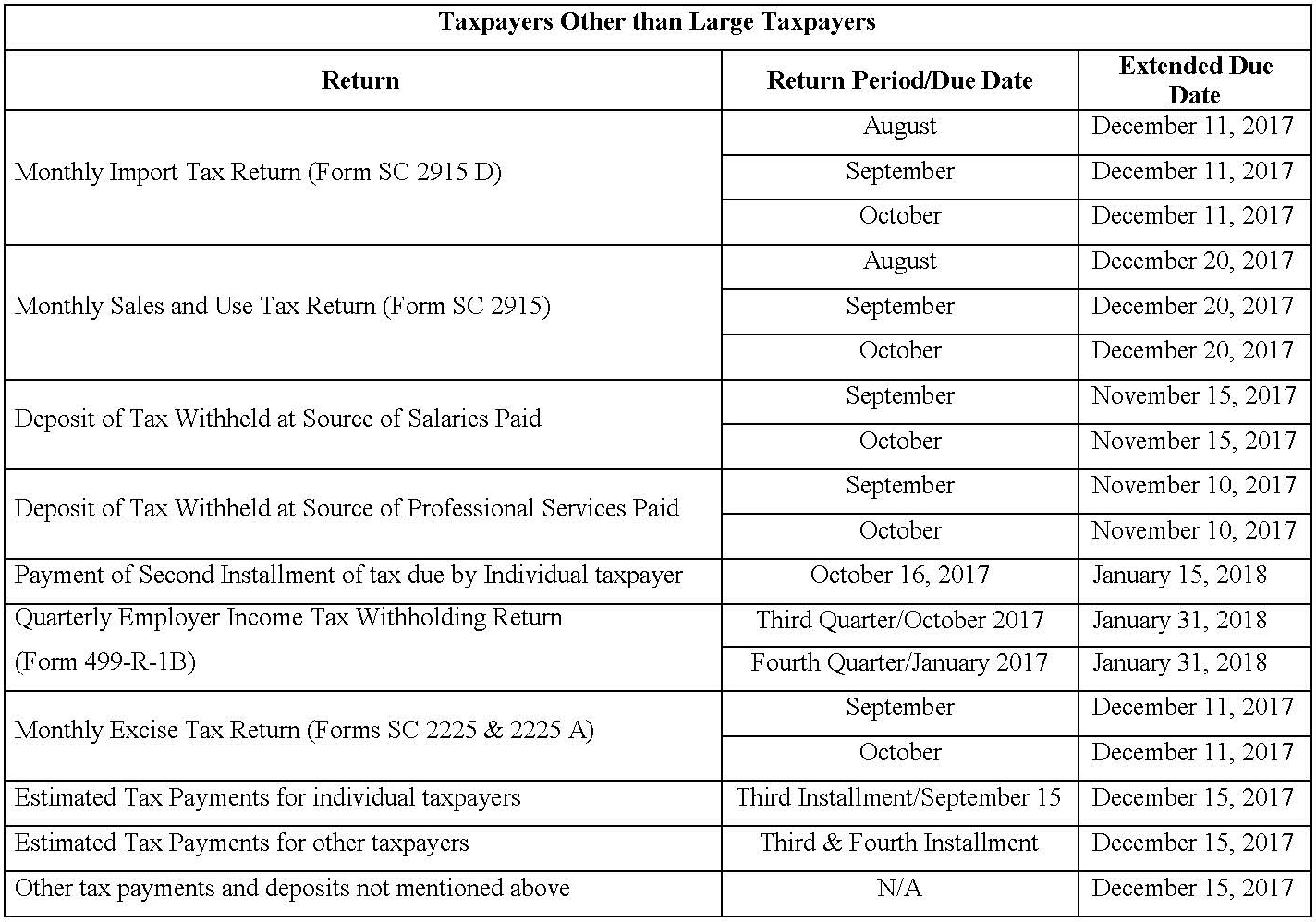

On October 19, 2017, the Secretary of the Puerto Rico Treasury Department (the “PRTD”) published Internal Revenue Informative Bulletin. 17-25 (“IB 17-25”) to notify that certain specific filings and payment requirements are postponed due to the passing of Hurricanes Irma and Maria through Puerto Rico. Accordingly, please find below a summary of the new filing and payment dates for taxpayers:

A “Large Taxpayer” as defined under Section 1010.01(a)(35) of the Puerto Rico Internal Revenue Code of 2011, as amended, is any taxpayer engaged in trade or business in Puerto Rico that complies with at least one of the following:

- Is a commercial bank or trust company;

- Is a private bank;

- Is a brokerage or securities company;

- Is an insurance company;

- Is an entity engaged in the business of telecommunications; or

- Is an entity with a volume of business of $50,000,000 million or more for the preceding taxable year.

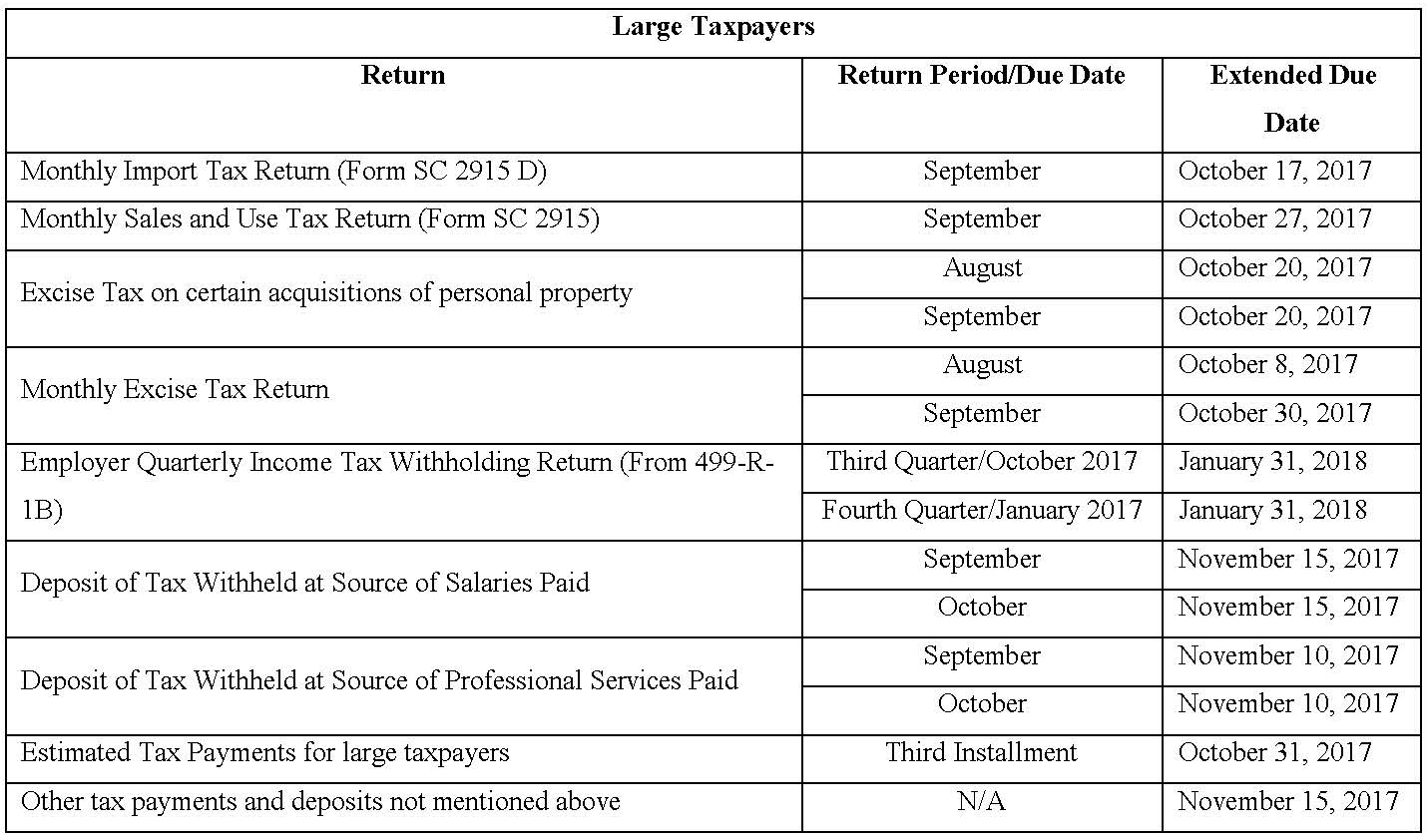

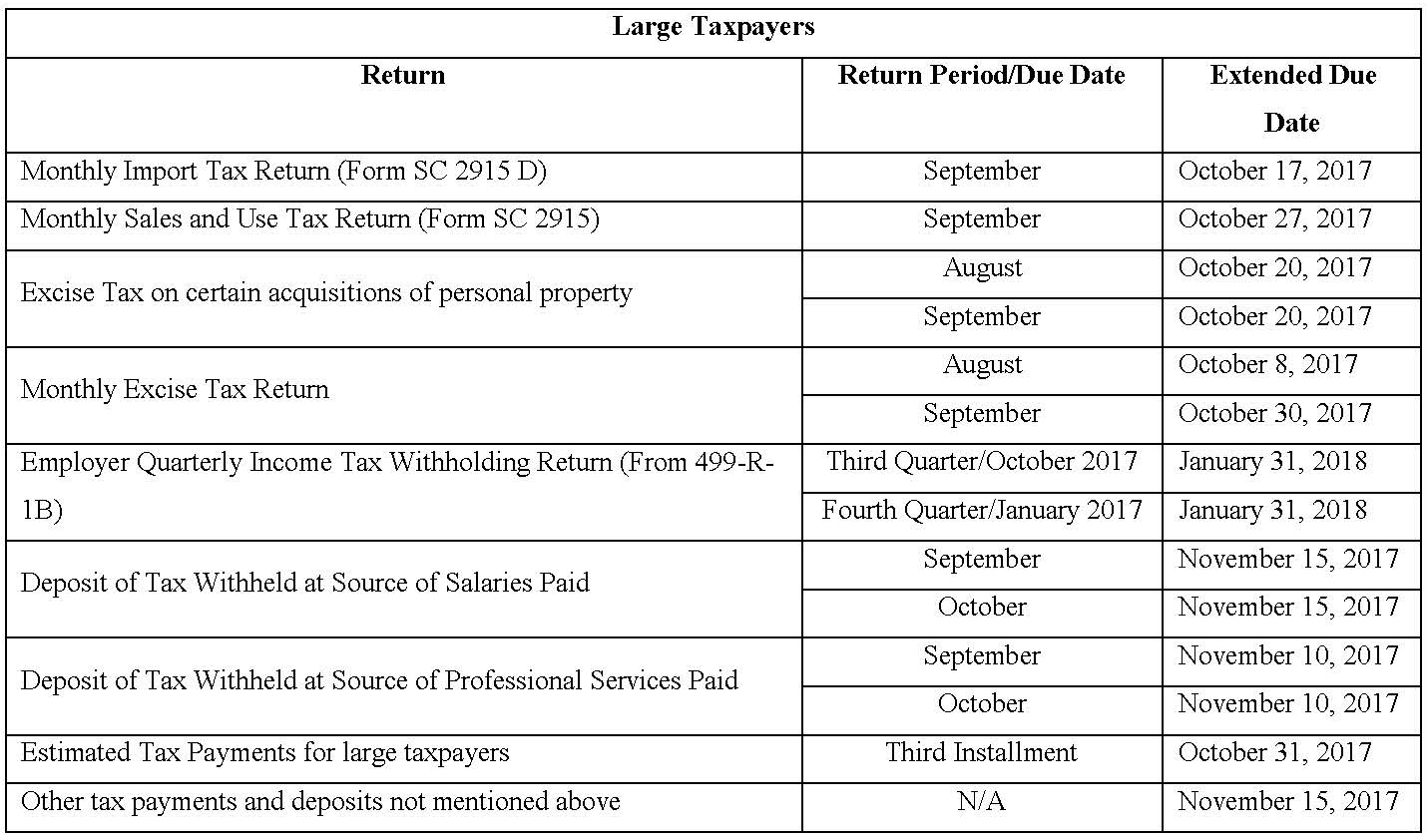

Accordingly, please find below a summary of the new filing and payment dates for “Large Taxpayers”

Requirements of Information from the PRTD – All requests of information regarding tax audits issued by the PRTD are suspended until further notice.

Requirements of Information regarding form SC 6048 – the period to submit the requested information regarding tax credits reported on form 480.71 are postponed until December 15, 2017.

Other Request and Elections:

- Partnership tax elections (Form SC 6045) – the notification or election of partnership tax treatment due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- Corporation of Individuals Election (Form SC 2640) – the request of election of corporation of individuals due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- The request of exclusion of certain expenses incurred or payments paid to a related party based on Section 1033.17(a)(17)(D) of the Puerto Rico Internal Revenue Code of 2011, as amended (the “Code”) due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- Request of any administrative determination due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- Request of change of accounting method due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- Request of change of accounting period due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- Puerto Rico estate tax returns due between the dates of September 5, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

- Puerto Rico gift tax returns due between the dates of September 18, 2017 and December 31, 2017 can be filed on or before January 31, 2018;

Renewal of Merchants Registry, Reseller Certificate and Manufacturers Exemption Certificate for Sales and Use Tax

The PRTD has extended the period of duration of: (i) Merchant’s Registration Certificate; (ii) Manufacturers Exemption Certificate for Sales and Use Tax; and (iii) the Municipal Reseller Exemption Certificate. If any of the above mentioned certificates expire from September 5, 2017 through December 31, 2017, then the certificate will now expire on January 31, 2018.

Bonded Merchants

Bonded merchants pursuant to the definition of Section 4042.03(b)(3) of the Code, that have bonds expiring between September 1, 2017, and January 31, 2018, will continue to be classified as a Bonded merchant during said period without the need to renew the bond.

Quarterly Reports for Sales and Use Tax purposes pursuant to Act 25 of 2017

The PRTD has eliminated the filing of the quarterly sales and use tax returns for non-withholding taxpayers as defined by Section 4020.08(e) of the Code for the quarter ending on September 30, 2017 due on October 31, 2017. Subsequent quarters must be filed pursuant to Section 4041.03(b)(1)(B) of the Code.

Credit Income Tax Returns for taxpayers over the age of 65 and credit for pensioners with low income

The PRTD has postponed the due date for filing Form 481.1 (originally due October 14, 2017) which can now be filed on or before January 31, 2018.

License Renewals

All taxpayers who have licenses issued which renew during the months of September or October 2017 will have an additional sixty (60) calendar days to renew said license along with the payment of the corresponding fees. Upon renewal, the newly issued license will have a retroactive date based on the original date that the license was supposed to be renewed.

Additional procedures with the PRTD

Any documents, requirement, payment, or procedure before the PRTD that is not discussed by IB 17-25 which has a due date after September 5, 2017, will be automatically extended to January 31, 2018.

Waiver of Penalties, Fines, Interests and Surcharges

The PRTD has clarified that taxpayers that comply with the above mentioned updated due dates will not be subject to penalties, fines, interests and/or surcharges. If a taxpayer receives a notice of penalties, fines, interests and/or surcharges, the PRTD will concede a reasonable term to request a clarification and waiver of said notice.

This document has been prepared for information purposes only and is not intended as, and should not be relied upon as legal advice. If you have any questions or comments about the matters discussed in this notice, wish to obtain more information related thereto, or about its possible effect(s) on policy or operational matters, please contact us.