Taxes and Employee Benefits Department

Notice to Clients and Friends:

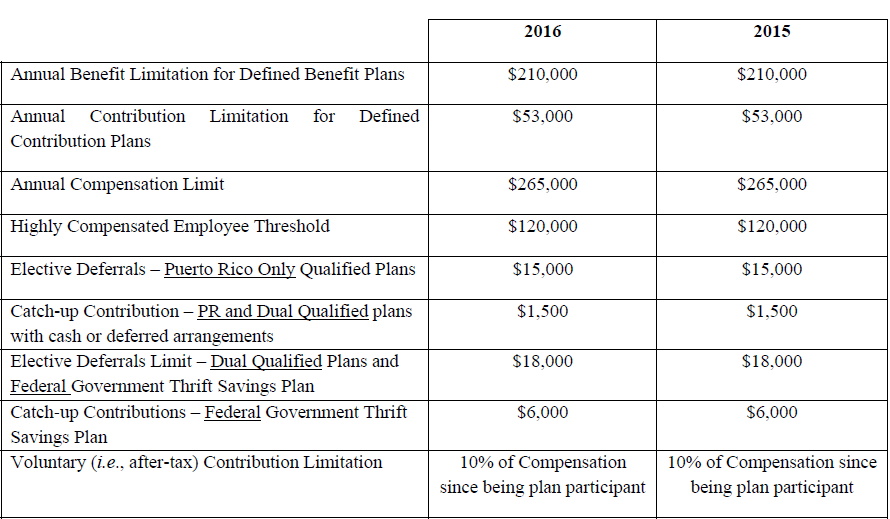

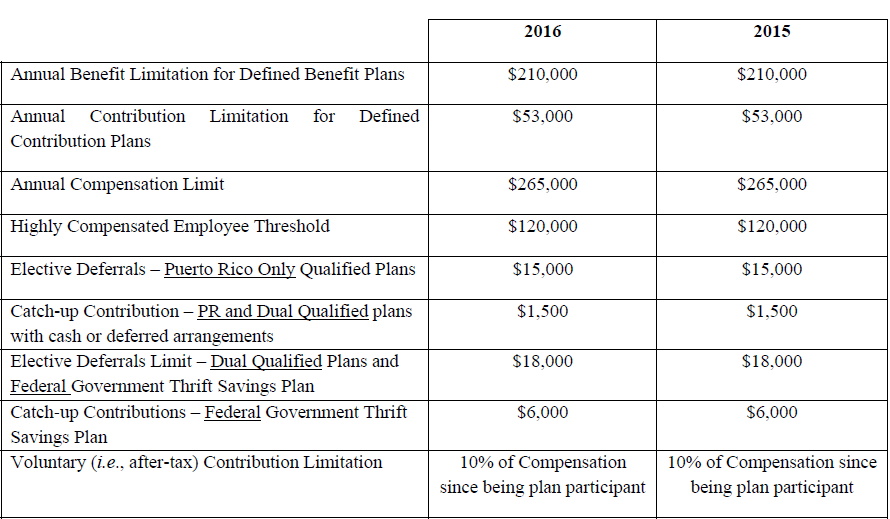

As required by Section 1081.01(h) of the Puerto Rico Internal Revenue Code of 2011, as amended (the “PR Code”), the Puerto Rico Treasury Department recently issued Circular Letter of Tax Policy No. 15-16 with the applicable 2016 dollar limits for Puerto Rico qualified retirement plans, following the recent announcement by the Internal Revenue Service (“IRS”) in IRS News Release IR-2015-118 with respect to United States tax qualified retirement plans. The Puerto Rico limitations are generally applicable to tax qualified plans under Section 1081.01 of the PR Code. None of the key limits were changed; however, we include both of the 2016 and 2015 limits for your ready reference as follows:

This document has been prepared for information purposes only and is not intended as, and should not be relied upon as legal advice. If you have any questions or comments about the matters discussed in this notice, wish to obtain more information related thereto, or about its possible effect(s) on policy or operational matters, please contact us.

- René J. Avilés García – raviles@ferraiuoli.com

- Pedro P. Notario Toll – pnotario@ferraiuoli.com

- Ediberto López Rodríguez – elopez@ferraiuoli.com

- Alexis Gonzalez Pagani – agonzalez@ferraiuoli.com

- Tatiana Leal – tleal@ferraiuoli.com

- Reinaldo Díaz Pérez – rdiaz@ferraiuoli.com