Tax & Employee Benefits Department

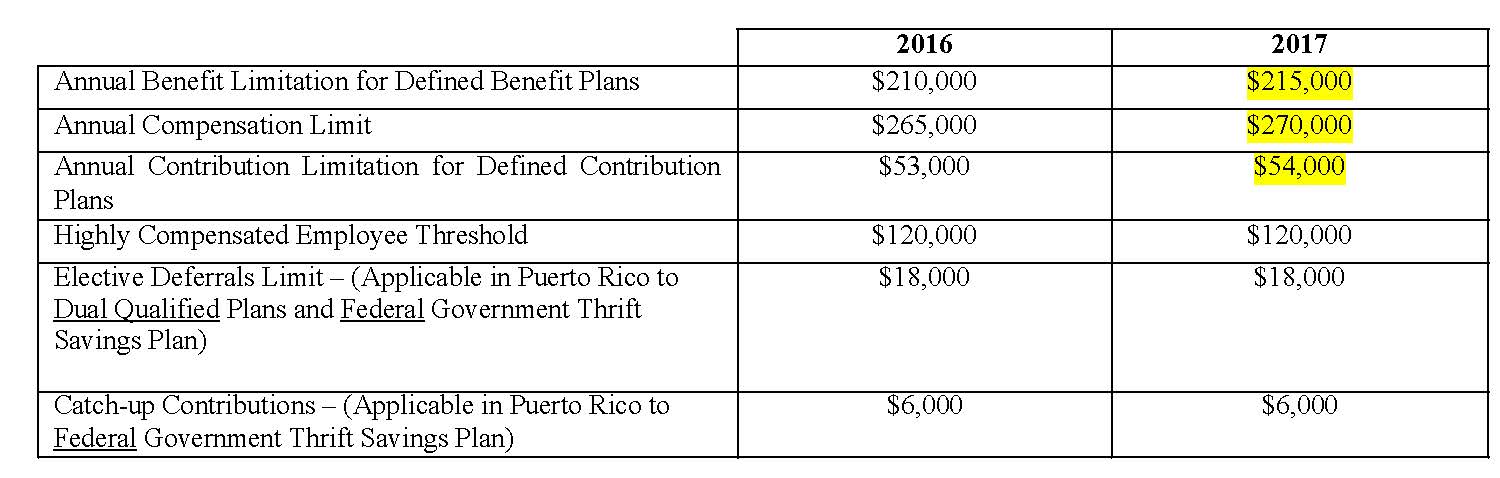

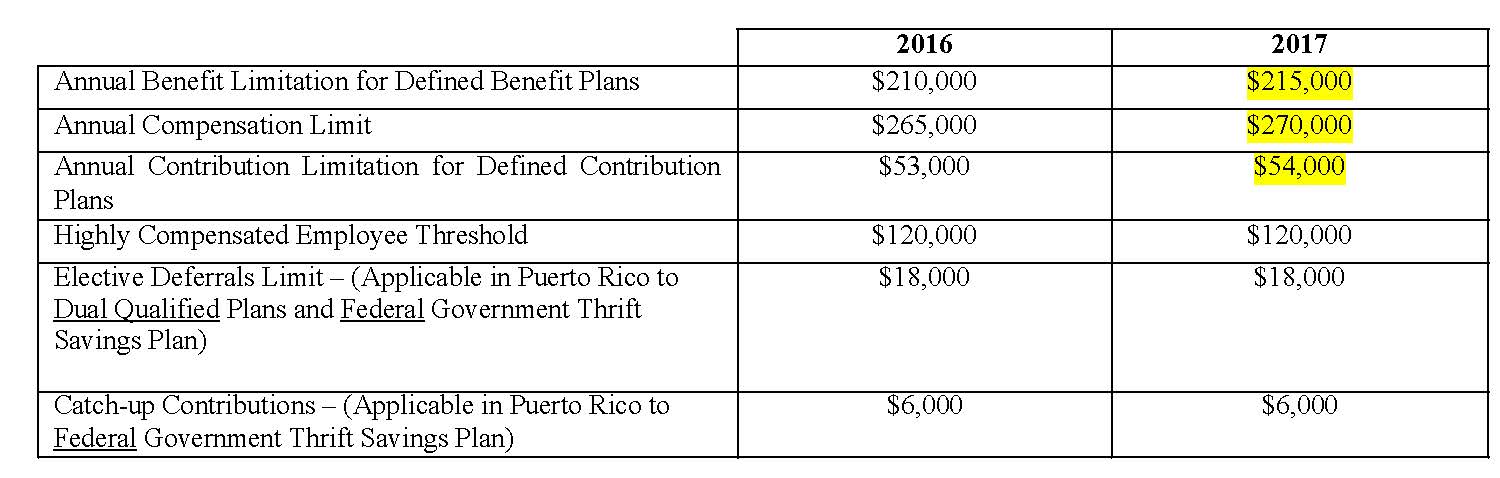

The Internal Revenue Service (“IRS”) recently announced retirement pension plans’ applicable cost-of-living adjustments affecting dollar limitations for the tax year 2017. Some of the key limits for the tax years 2017 and 2016 of importance to Puerto Rico tax qualified plans are as follows with changes highlighted in yellow:

This announcement generally applies to qualified plans under the United States Internal Revenue Code of 1986, as amended (the “US Code”). However, employers and administrators of tax qualified plans under the Puerto Rico Internal Revenue Code of 2011, as amended (the “PR Code”), must be aware that Section 1081.01(h) of the PR Code requires that, before every taxable year, the Puerto Rico Treasury Department (the “PRTD”) notify the cost-of- living adjustments announced by the IRS that will, in turn, apply to plans qualified under the PR Code. Accordingly,

it is expected that the PRTD issues upcoming guidance to announce these same plan limits for PR Code tax qualified plans for the tax year 2017 as it did last year in PRTD Circular Letter of Tax Policy No. 15-16. We will update you as soon as we receive confirmation from the PRTD to this end.

This document has been prepared for information purposes only and is not intended as, and should not be relied upon as legal advice. If you have any questions or comments about the matters discussed in this notice, wish to obtain more information related thereto, or about its possible effect(s) on policy or operational matters, please contact us.